Highlights

- Companies focusing on AI reasoning—such as cloud computing service providers, edge computing companies, and AI application enterprises—are likely to see strong growth in market demand.

- More importantly, we believe that future regulatory measures will be relaxed, including those in the AI field.

- Bitcoin and blockchain technology are becoming the core of this major revolution in the financial services industry, and in addition, Bitcoin is gradually evolving into a part of the global monetary system.

- The strongest bull markets are those that are broad-based across sectors, not dominated by just six or seven stocks.

- This again ties in with the idea that costs are falling dramatically. Costs were already falling, and DeepSeek has simply accelerated the process.

Competition with DeepSeek is good for the US

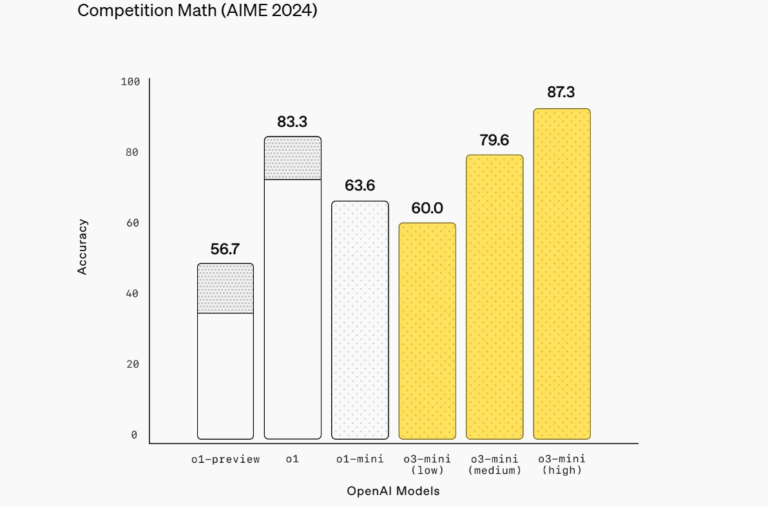

Cathie Wood: I think it shows that the cost of innovation is falling dramatically, and that this trend has already started. For example, before DeepSeek, the cost of training artificial intelligence fell by 75% per year, and the cost of inference even fell by 85% to 90%. I think this also means that the importance of inference chips is rising relative to training chips. Therefore, NVIDIA is highly respected in the field of training chips, as it should be, but the inference market is more competitive.

Hoster: Do we really understand the impact of this change? The question on everyone’s mind today is: “Should I buy now?” If the market landscape is changing, is it too early to make adjustments and judge their impact?

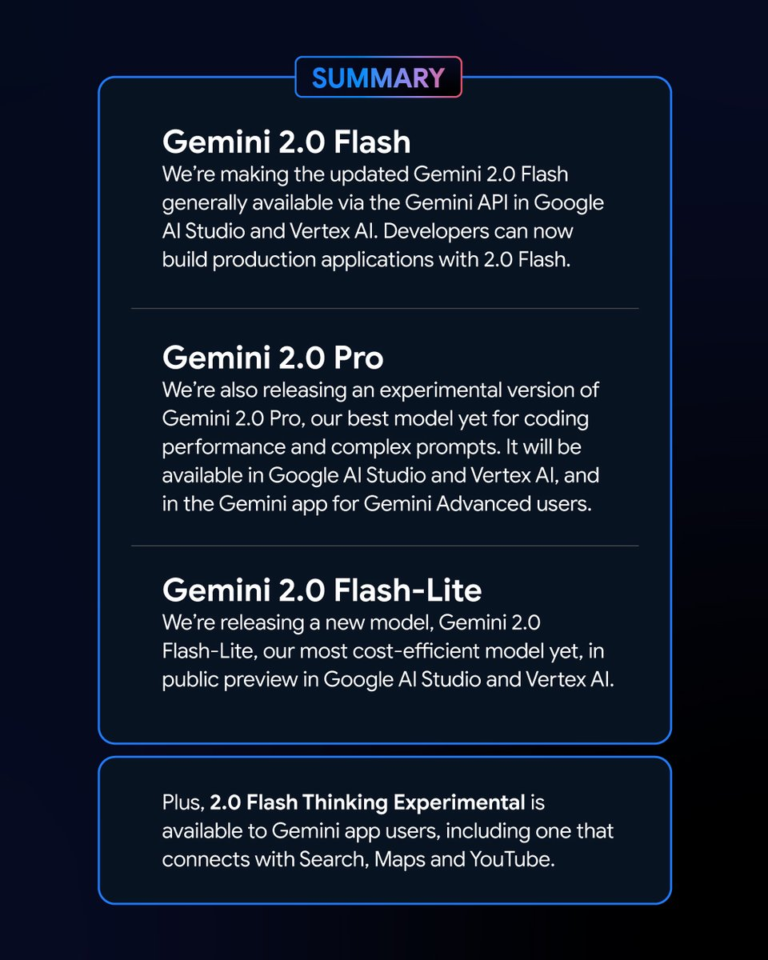

Cathie Wood: Yes, we have been studying the development of the technology stack and will publish an important report on future trends in about a week. We believe that market share within the technology stack is shifting. We are bullish on PaaS, for example, and Palantir is expected to gain more market share in this area. Yesterday’s news just confirms and reinforces this trend. The market share of IaaS will stabilize, while the market share of SaaS may decline slightly. Nevertheless, these areas are still growing rapidly, just at different rates.

Hoster: If the cost of inference decreases, will that drive greater market demand? As we discussed before, will companies that are not responsible for training but focus on inference benefit more as a result?

Cathie Wood: The cost of inference will decrease significantly. This means that companies can deploy AI models more efficiently and economically without having to bear the expensive training costs. Therefore, companies that focus on AI inference – such as cloud computing service providers, edge computing companies, and AI application companies – are likely to see strong growth in market demand.

Currently, we believe autonomous driving (including cars, drones, etc.) and healthcare are the two most important application fields. Especially in the medical field, we believe that the fusion of genetic sequencing technology, artificial intelligence and CRISPR gene editing will gradually cure more diseases in the future.

Hoster: What does this mean for the US technology industry? As we discussed yesterday, does the US technology industry still have a unique advantage? Although this may be questionable in terms of the overall stock market, in the technology sector, we believe that this is not the “end of American exceptionalism,” but more like a “Sputnik Moment,” an opportunity for the US to catch up that it needs to seize?

Cathie Wood: DeepSeek is indeed a formidable competitor, and the current leaders in the technology world have spoken highly of it. But we still have limited knowledge of all its details. Therefore, I think competition is good for the United States, and lower costs are also a good thing for the global economy. President Xi Jinping proposed the concept of “new qualitative productivity” 18 months ago. The previous concept of “common prosperity” focused more on profits, but the current trend is about innovation. So we are now paying more attention to the Chinese market.

Hoster: It is worth noting that the significant reduction in innovation costs may make it easier for medium-sized technology companies and even some startups to enter the market, rather than just the “hyperscalers” dominating the market. However, at present, the growth in the AI field is mainly concentrated in technology giants such as Amazon, Microsoft and Oracle, and smaller technology companies have not yet enjoyed this dividend. If the cost of innovation decreases, why doesn’t the stock market reflect this?

Cathie Wood: This is a controversial question. Judging from the market trends in the second, third and fourth quarters of last year, large technology stocks performed well in the second and fourth quarters, while small and medium-sized stocks performed even stronger in the third quarter. There is currently some kind of game going on in the market.

If we are correct, then the extreme concentration of the current market – which is even more serious than during the Great Depression – will gradually spread to a wider range of markets. We have already seen signs of this in our portfolios, and this change happened right after the US election. And most importantly, we think that future regulatory measures will be relaxed, including those in the field of AI. At present, the US government is overly involved in the regulation of AI, which is now at a stage similar to the Internet in the early 1990s. We don’t even understand its full potential. Therefore, now is not the time for over-regulation.

Should you increase your investment in hyperscale technology companies?

Hoster: You are known for your beta strategy, especially in the technology sector. The highest beta values are currently being posted by some technology companies, such as NVIDIA, Microsoft and Google, just look at the market fluctuations of the past 24 hours, not to mention the past 12 months. Why not increase your holdings to gain more exposure to hyperscalers?

Cathie Wood: Our flagship fund does hold Meta and Amazon, and more in other more specialized portfolios. In addition, in Europe we have an artificial intelligence and robotics fund, in which we probably hold most of the relevant companies, because they will benefit from the decline in the cost of artificial intelligence. Even Meta is a leader in the open source field. DeepSeek is open source. I think Meta is probably thinking, “Wait, what’s going on here?” now. They will use some of the technologies and algorithms adopted by DeepSeek to improve their own platform. So we are not pessimistic about these companies.

The market’s neglect of other sectors has reached an extreme, and this is about to change. The strongest bull market is one that covers a wide range of industries, not one dominated by just six or seven stocks. If we are right, the bull market will expand more widely and gain momentum, rewarding more small-cap stocks, not just the big companies we are seeing right now.

Do you have to have huge amounts of money to invest in AI?

Hoster: Meta is a good example. Meta made a big bet on metaverse before fully committing to artificial intelligence, but the investment suffered a significant drawdown at that time. So, to succeed in the field of artificial intelligence within the next five years, do you have to have a cash reserve of billions or even trillions of dollars?

Cathie Wood: I think DeepSeek has taught us that the amount of capital required is much less than people think. We used to think that a lot of capital was needed, but in fact it may not be necessary. I’m not sure if the figure of $6 million is accurate, but if it is, it’s incredible, just one tenth or less of the cost in the past. However, many people still have doubts about this.

This again fits with the idea that costs are falling dramatically. Costs were already falling, and DeepSeek has simply accelerated the process.

Hoster: How do you think American technology companies or businesses will react to DeepSeek, this new technology from China? This could raise concerns for some people, given the issues surrounding TikTok and where the data flows.

Cathie Wood: Many people think Trump’s return is negative for US-China relations, but we can also find some parallels in history. It reminds me of Nixon’s visit to China. Nixon didn’t trust China, but precisely because he didn’t trust China, the American public and political circles trusted his decisions.

From a technical perspective, I think Trump likes competition. He believes that some US regulations – in particular the AI executive order he revoked – may have indeed slowed down our technological progress, and it is now time to speed up.

Will changes in market concentration lead to sharp fluctuations?

Hoster: You mentioned the high concentration of the market and the dominance of individual stocks in the market. Do you think the market will smoothly transition from the current high concentration to a more widely diversified landscape? Historically, the Great Depression did not teach us this lesson. Instead, it taught us that such a transition is usually accompanied by a market crash. Nowadays, consumer confidence and many economic indicators in the United States seem to be closely dependent on the performance of the stock market. Will the transition from the current market concentration to market diversification be a smooth process? Or is it possible that there may be considerable fluctuations between the two?

Cathie Wood: If we look back at the Great Depression, I may not remember all the figures exactly, but we can see that the market was highly concentrated until 1932. Then the market began to expand, and it is logical that small-cap and mid-cap stocks performed much better than large-cap stocks at that time. Because during the Great Depression, these small companies had already suffered greatly, to the point of survival – the market was worried about whether these companies would survive. At the time, industrial output fell by 30%, and GDP also fell by 30%. So the market did not change smoothly, but experienced huge shocks.

What surprised me is that the concentration of our market is even higher than it was during the Great Depression. This shows that the market is actually full of fear at a deeper level. Investors have flocked to cash-rich companies, and the emerging field of artificial intelligence may also have an advantage. However, I believe that the market is about to undergo a broader expansion.

What will happen to Bitcoin after Trump’s new term and deregulation?

Hoster: Bitcoin is currently trading at around $103,000. You have always been a strong supporter of cryptocurrencies. You have talked about the Trump administration deregulating the technology sector, which also involves deregulating the cryptocurrency sector. So, what fundamental changes have there been in terms of deregulation since he took office?

Cathie Wood: We will have a clearer regulatory framework and there is likely to be new legislation. Many policymakers in Washington have now realised that this is actually a key voting issue for many voters, especially younger voters. So the topic is gradually becoming a more bipartisan issue.

And of course, the executive branch is also strongly supporting this trend, for example by proposing to include Bitcoin in the Treasury’s reserves. So I think we may see all three branches of government taking a supportive stance towards cryptocurrencies, which would be a huge change.

Hoster: But the question is, can we really be sure of this? After all, SEC Chairman Gary Gensler holds a completely different view of the risks of cryptocurrencies and the protection of retail investors. There are still many people who believe that increased regulation is necessary.

Cathie Wood: Yes, but I don’t think he really understands what cryptocurrencies represent in terms of the next wave of the internet revolution. This is actually a new dimension of the internet, part of which developers did not build in the early 1990s. At the time, no one thought that people would want to buy or use financial services on the internet. I remember that hardly anyone wanted to enter their credit card details online, but now it is one of the world’s leading payment methods.

Bitcoin and blockchain technology are at the heart of this major revolution in the financial services industry. And Bitcoin in particular is not just a digital currency, it is the leader of a whole new asset class. We recently published a paper that shows Bitcoin’s low correlation, which is key to defining a new asset class.

Moreover, Bitcoin is gradually evolving into a part of the global monetary system. My mentor, friend, and economist Art Laffer has shown great enthusiasm for Bitcoin. In 2015, when he collaborated with us on the Bitcoin paper, he said, “This is what I have been waiting for since the United States closed the gold window in 1971.” He is looking forward to the rule-based global monetary system represented by Bitcoin, and this rule-driven financial system is precisely the core value of Bitcoin.

Hoster: Do you think Trump will support this trend? After all, the president has made it clear that he is a staunch supporter of the US dollar. And your views sound more like you are proposing an alternative to the US dollar.

Cathie Wood: We believe that Bitcoin and the US dollar can coexist. In fact, we see the way to decentralized financial services in the trend towards stablecoins. Stablecoins are usually backed by US Treasuries, and they are still based on the US dollar. Therefore, with the relaxation of regulation, this trend will accelerate even further.

Hoster: You say cryptocurrencies are rule-based, but we keep seeing new ones emerge.

Cathie Wood: Yes, Bitcoin is rule-based – its total supply is 21 million, and it is currently approaching 20 million. It is this scarcity that will keep Bitcoin valuable in the future.

Hoster: If Stablecoins are essentially backed by the US government, why not just develop a digital dollar?

Cathie Wood: I live in Florida, and Governor Ron DeSantis has made it clear that he would never allow a central bank digital currency (CBDC) to be circulated in the state. Texas seems to have taken the same stance. This is a matter of state rights, and it is essentially about privacy protection. In Europe, many people may think that Americans don’t care so much about privacy, but that is not the case. We are very concerned about privacy on this issue, and the Trump administration clearly supports this position.

Hoster: One question from the audience is that the biggest driver of cryptocurrency has always been its speculative nature and its deregulated attributes. But if various regulatory conditions are added to stablecoins, bitcoins or other tokens, will this undermine their attractiveness? After all, it was this deregulation that drove the price of bitcoin past $103,000.

Cathie Wood: I completely disagree with this view. I thought you would question the emergence of new tokens in the market, in fact, we have experienced similar market cycles.In the past, there have been a lot of new token issues, but in the end, it is the crypto assets with real value and rules, such as Bitcoin, that will survive. The 2017 ICO (Initial Coin Offering) craze saw Bitcoin soar from less than $1,000 to $20,000, but most ICO projects eventually failed. This is why investors need to be cautious, and it also shows that the market does need a certain degree of regulation, otherwise it may get out of control. Bitcoin is completely different. It is a completely different asset class.

Hoster: So isn’t Bitcoin an asset that is highly correlated with technology stocks? Isn’t that what the market taught us yesterday?

Cathie Wood: No. Bitcoin is indeed part of the wave of technological innovation, but its market performance is not entirely consistent with that of technology stocks. Although statistically, Bitcoin and technology stocks are highly correlated, a closer analysis shows that it can act as both a risk-on and risk-off asset in different market environments. For example, in the spring of 2023, when the US regional banking crisis broke out, the price of Bitcoin soared. This is because Bitcoin has no counterparty risk, while the traditional banking system is full of counterparty risk. This is precisely what makes Bitcoin unique – it is not just a technology asset, but also a decentralized financial hedging tool.

Hoster: If technology stocks fall sharply, will cryptocurrencies fall sharply?

Cathie Wood: There is a correlation between the crypto market and the technology market, but this correlation is not as high as that between small-cap stocks and large-cap stocks. As institutional investors increase their participation, the market performance of bitcoin may converge more with that of traditional financial assets, but for now, bitcoin is still a relatively independent asset class based on statistics on return rates and risk distribution.