On February 9, French President Emmanuel Macron announced that France would invest 109 billion euros (113 billion US dollars) in the field of AI in the next few years. This investment will be used to build an AI park in France, improve the infrastructure, and invest in local AI start-ups.

Meanwhile, Mistral, a French startup, has just launched Le Chat, an AI assistant, which has also topped the French download charts.

At the beginning of 2025, the United States launched the Stargate program with an initial investment of 100 billion US dollars, and DeepSeek from China also became very popular. France, on the other hand, has had the strongest presence outside China and the United States since the beginning of the year.

France’s AI industry is not like Turkey’s, which relies on shelling and monetization techniques to focus on the application layer. Its AI startups have a certain degree of investment and accumulation in underlying capabilities. For example, Mistral AI’s released model Mistral-7B has been the world’s best open source model for a long time. Another example is Photoroom, which is an AI application layer, but it has developed its own underlying model, and its image segmentation capabilities are also leading in similar products.

In addition to these relatively well-known startups, video editing product Submagic, Talking Video product Argil, the world’s largest AI model sharing platform HuggingFace, and other products we have observed on our list or other topics, are also from France.

And this time, with the backing of a government investment of 100 billion, France has become a force to be reckoned with in the global AI competition.

In the era of AI, France wants to be a “global leader”

Although France was not the first developed country in the world to pay attention to AI, the French government has been “crazy about spending money” since the beginning. With the government’s leadership, investment and financing in the French AI industry has also been quite active. In terms of talent, France is also not far behind. With the support of capital and talent, the development of AI in France is naturally very fast.

In 2018, the French government released the “AI for Humanity National Strategy”. The first phase will last five years, and 1.5 billion euros (about 1.7 billion US dollars at the time) will be invested in the development of the AI industry. Although France was not the first to “launch a national strategy,” it is among the developed countries that have invested the most (although Germany has also invested heavily, but the cycle is longer, and there is also a gap in the total economic output between Germany and France). The government’s leadership did indeed drive the development of the AI industry in the early stages.

Another “byproduct” of the government’s active investment is that investment and financing in the French AI industry is also very active. In the first half of 2024, French AI companies ranked first in Europe with a financing amount of 2.29 billion US dollars, and Paris has also become a European AI center on par with London.

The most representative example of this is that the “old money” in France has begun to pay attention to AI. For example, the current richest man in the world, Bernard Arnault, president of the LVMH Group, invested more than $300 million in five AI companies through his family office Aglaé Ventures in 2024 alone.

In addition, in September 2024, France appointed the world’s first minister of artificial intelligence, and President Macron has also been meeting frequently with experts in the field of AI and has called on multiple occasions for increased support and investment in the AI industry. In the foreseeable future, the development of the AI industry in France can still leverage the support of the government and “big players”.

Talent: grow up locally and “gain experience” globally

In addition to funding, talent is also an essential prerequisite for the development of the AI industry.France itself has a relatively good educational foundation, and practitioners are actively going abroad to gain experience at top AI companies/research institutions around the world. Therefore, French AI entrepreneurs generally have high quality.

As early as the 1970s and 1980s, France had already established a number of research teams related to artificial intelligence. The education sector also attaches great importance to disciplines related to mathematics and computers, and has cultivated many talents. For example, Yann LeCun, a scientist who won the 2018 Turing Award with Professor Geoffrey Hinton, the “father of AI,” for “convolutional neural networks,” is French.

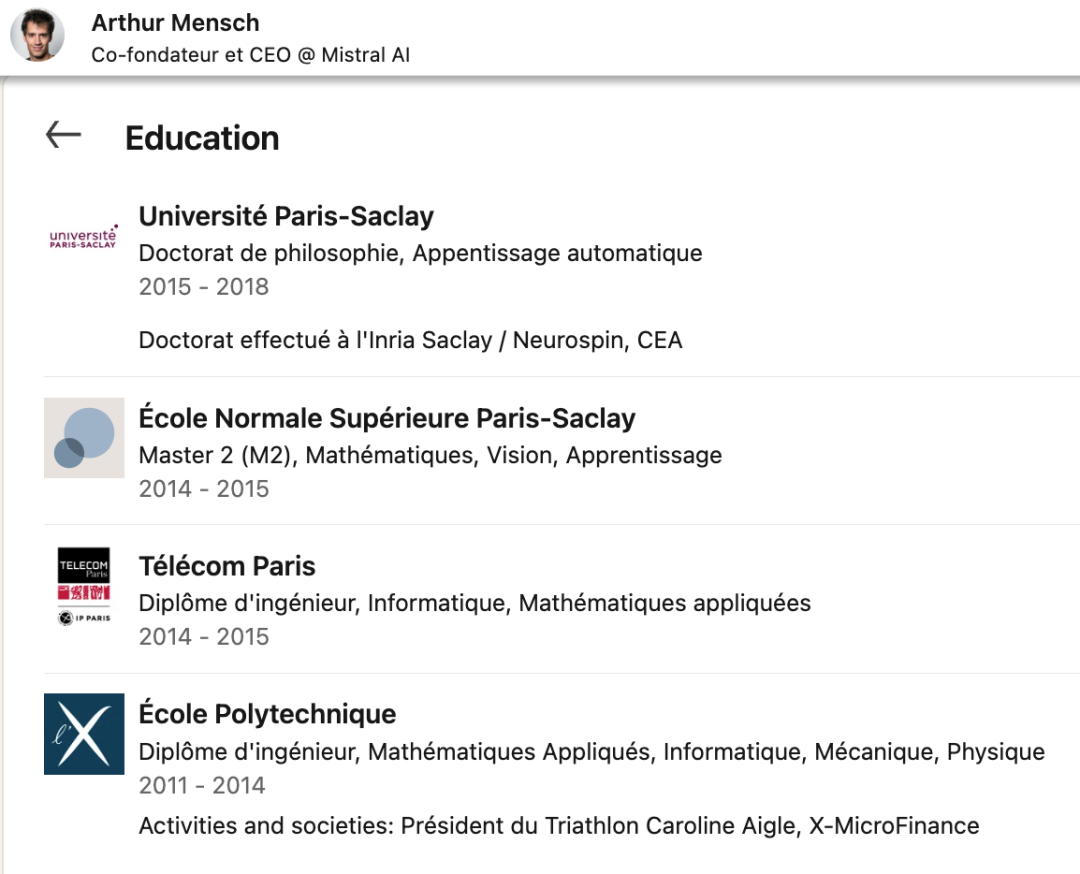

Unlike many other countries, where most AI founders have studied in the United States,French AI talent tends to be educated in their home country.For example, Arthur Mensch, the founder of Mistral, France’s most well-known big data startup, completed his doctorate in France.

From a broader perspective, data shows that57% of French AI startup founders, like Arthur Mensch, graduated from the Ecole Polytechnique, which is a very high percentage.

After completing their studies at home, French AI talents are also keen to study abroad. Let’s take a look at Arthur Mensch’s experience. After completing his doctorate, he conducted postdoctoral research at New York University and the École Normale Supérieure in Paris. He then joined DeepMind in 2020, and only returned to France two years later to found Mistral.

The proportion of French AI startup founders who have worked in major AI companies and research institutions

and his work experience is also very representative. According to the data, 11% of French AI founders have worked at Google, 5% have worked at DeepMind, and the proportion of those who have worked at other companies/institutions is not low. Exchanges with the world’s top talent have also greatly enhanced the vision and technical capabilities of French AI founders, laying a foundation for entrepreneurship.

Overall, in terms of AI development, the French government, education sector, capital market and entrepreneurs have formed a synergy. The education sector produces talent, and the talent gains experience at top companies and research institutions around the world. With strong support from the government and the capital market, these “potential founders” from the French education system are also very willing to start a business in France, creating a virtuous cycle.

With funding and talent,France’s overall AI strength is still not as strong as that of more powerful countries such as the United States and China, but the top startups have already reached the top global level, and France can also be considered a top-level player in the AI industry.

From models to applications, it has a presence in all the popular fields, and some of its products are among the best in the world

Unlike Turkey, which we previously observed as focusing on AI application products for the app side, French startups place great emphasis on basic models. France also has well-known large model companies such as Mistral.AI and H.ai. At the application level, France is also not weak, with AI products such as Photoroom that can already generate good revenue.

Mistral: Europe’s leading model company

Latest round of financing: In June 2024, it completed a US$640 million Series B financing round, with a valuation of US$6.4 billion and a total financing amount of US$1.1 billion. Although it is one of the leading companies in Europe, it is not considered very high when compared to global AI companies.

Founder: Arthur Mensch (former DeepMind scientist)

Mistral was founded in April 2023 and focuses on open source models. Before Meta’s Llama3 was launched, the Mistral 7B model was the world’s “strongest” open source model. Mistral is almost the only big model startup in Europe that can rank among the best. Mistral’s recently launched Chatbot product Le Chat is also online, and it has achieved good results on the French App list.

Although the model is indeed well done, Mistral is also facing a potential crisis. According to a report by The Information, although Mistral can generate some revenue from its API, only 10% of customers are willing to pay for the API, and Mistral’s current revenue is far from enough. In contrast, Meta is able to rely on traditional advertising to “transfuse” research and development for the open source model, and Mistral’s model is clearly less sustainable. Although Mistral has also tried to launch a closed source model, the results have not been good.

If Mistral cannot find an effective commercialization path in the future, it may be inevitable to be acquired. However, according to the latest statement by Mistral CEO, the company’s cash flow is still sufficient, and they prefer to be able to go public for financing rather than being acquired.

Hugging Face: the “main battlefield” for open source AI

Latest round of financing: In August 2023, it completed a $235 million Series D financing round, with a valuation of $4 billion and a total financing amount of $395 million.

Founder: Clem Delangue (serial entrepreneur)

Hugging Face is the world’s largest open source model sharing platform. It brings together a large number of open source AI models and AI tools, and major manufacturers also choose to release their open source models on HuggingFace. In December 2024, Hugging Face had 21.31 million visits and entered the global AI website traffic Top 50.

In terms of commercialization, Hugging Face adopts a “free + value-added services” profit model, which means providing free basic services and generating revenue through model deployment and API services, customized solutions for enterprises, training courses, and cooperation with cloud service providers. According to a report in the French newspaper Le Monde in September 2024, Hugging Face became profitable in the 2024 Q3 quarter.

H: A mysterious startup that raised $220 million in its seed round

Latest round of financing: Completed a $220 million seed round in May 2024, with an undisclosed valuation.

Founder: Charles Kantos (former Stanford researcher)

H was founded in 2024 by Charles Kantos, a former Stanford University researcher, and several other co-founders from DeepMind. H’s most notable achievement was its $220 million seed round, which included a very impressive investor lineup, including Accel, a well-known VC, Eric Schmidt, former CEO of Google, Bernard Arnault, president of the LVMH Group, and many others.

H’s main product direction is the automated AI Agent. In November 2024, H released its first Agent product, Runner H, which helps enterprises improve efficiency and is equipped with a self-developed compact model with 2 billion parameters.

At present, H has only launched a major ToB product, and its market presence is not as large as the above two startups. However, judging from the fact that it was able to attract so many “big names” in the seed round of financing, this startup should have something up its sleeve.

Photoroom: No. 1 in AI product images, with an ARR of US$65 million

Latest round of financing: In March 2024, it completed a US$43 million Series B financing round, with a valuation of US$500 million and a total financing amount of US$62.1 million.

Founder: Matthieu Rouif (former senior product manager at GoPro)

Photoroom mainly provides services for small B merchants in the context of AI product images, and its main functions are background removal, background replacement, shadow generation, etc.

Currently, Photoroom has 13.33 million website visits per month and ranks among the top 100 AI product websites in the world. In addition, on the app side, its global MAU for both platforms in December was 9.76 million, and revenue for the last 30 days was 2.667 million US dollars. Both user and revenue results are quite good. As of March 2024, the disclosed data shows that Photoroom’s ARR reached 65 million US dollars, which is considered one of the few AI products that have run through the PMF.

In addition, we also observed that in July of this year, Presti, an AI startup from France that creates furniture product images, completed a seed round of financing of 3.5 million US dollars. Overall, there are quite a few French startups that are deeply involved in the field of images.

Poolside.ai: an AI programming tool that can compete with Cursor

Latest round of financing: completed a $500 million Series B financing in October 2024, with a valuation of $3 billion and a total financing amount of $626 million. Its current valuation is higher than Cursor’s $2.6 billion.

Founder: Jason Warner (former GitHub CTO)

Poolside’s main product is an AI-powered programming tool designed to simplify the development process. Poolside seamlessly integrates with current development environments and provides developers with services such as suggestions, code generation, and error detection. Poolside can customize AI models for an enterprise’s coding style, libraries, APIs, etc.

Dust AI: An AI agent that improves enterprise efficiency

Latest round of financing: In June 2024, it completed a $16 million Series A financing round, with a total financing amount of $21 million.

Founder: Stanislas Polu (former OpenAI research engineer)

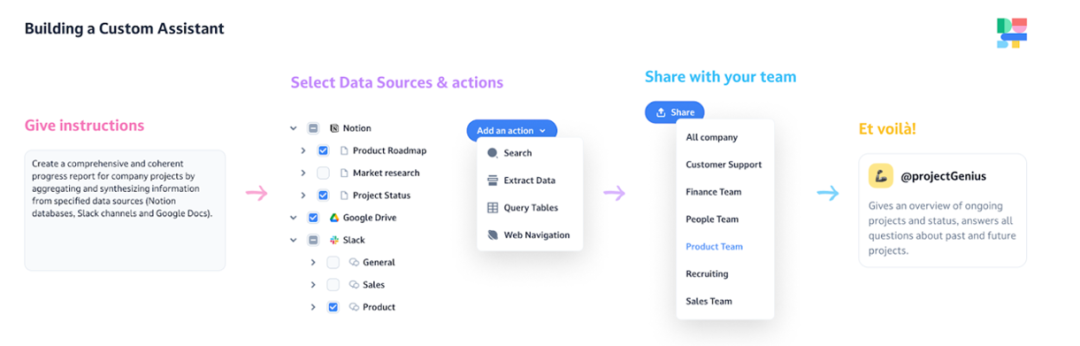

Dust’s main product is an AI assistant for enterprises. Its products can link data and files stored by companies or individuals on various platforms. Users can build multiple AI assistants based on the different needs of various workflows to improve work efficiency.

According to data disclosed by Dust itself in June this year, its ARR has exceeded 1 million US dollars, and the proportion of employees using Dust in customer companies averages more than 80%.

Overall, the industries that have enabled France to rank among the top 3 are actually commodity graphics, programming, open source models, etc. In terms of the number of startups and the results achieved, other tracks really cannot compare with countries with stronger AI industries such as China and the United States.

Below is a list of French AI startups that we could find: